By Luca Clivati, Senior Consulting Manager at Sovos

Trading outside the UK is an opportunity UK retailers might evaluate to increase customers and sales.

According to the latest information published on the UK Government website, UK trade in numbers, in 2019, the proportion of UK businesses exporting to the EU was only 10.2%. We’re expecting updated figures to available later this year.

Taking into consideration the period from May 2021 to May 2022:

- In terms of exports, UK trade registered an increase of 9.4%

- In terms of imports, these rose by 19.4%

The above should be read alongside the comparison for January-May 2021 and January-May 2022:

- Exports from the UK to EU Member States increased by 58.8% (from €54.4m to €86.4m)while

- Exports by EU countries increased by 28.9%

The huge difference between the increase of total exports by EU established companies, equal to 28.9% in comparison to UK established companies, of 9.4%, shows there is room for UK retailers to improve these statistics and play a more active role in cross-border trade.

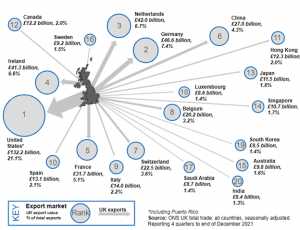

The largest EU partners for UK exporters, were Germany, the Netherlands, Ireland, and France (almost 26% of the total turnover – see picture below).

UK export markets for goods and services – four quarters to end December 2021

So, from these statistics which are the elements a UK retailer might take into consideration prior to trading abroad from a VAT perspective, and which countries are good routes to reach new customers?

1. Export from the UK to the EU: VAT implications

When a UK retailer exports, the place of supply will be the place where the goods are delivered from.

On the UK side, the supplies will be subject to UK VAT and a zero rate should be applied, provided that certain conditions are fulfilled. For example:

- Goods must be physically exported within specific time limits (currently three months); and

- Evidence (either official or commercial) must be provided to prove entitlement to zero rating, again within specific time limits (currently three months).

In terms of evidence and customs documentation to support the VAT treatment, the UK retailer will need to collect, among other documents:

- Official or commercial evidence of export using National Export System (NES) e.g. copy of Goods Departed Message (GDM) or screen print from Customs Handling of Import Export Freight (CHIEF) showing status codes;

- Supplementary evidence of export transactions may also be needed.

In the EU, duties (if applicable) and import VAT will need to be paid on these imports. Throughout the EU there are different ways to account for import VAT.

Generally, import VAT is due at the moment of import and can be recovered later via a local VAT return (e.g. like the current system in the UK) provided there is a requirement to be VAT registered.

However, as well as in the UK, the EU VAT legislation allows Member States to implement import VAT deferment and postponement schemes. These schemes can greatly impact the cash flow effect of importing into Europe.

Finally, we recall that an EORI number is essential for communicating with the customs authorities.

So, there are some essential points to bear in mind when importing or exporting goods from the EU:

- To export, the UK retailer needs a UK EORI number; and

- To import, in addition to an EU EORI number, in case the UK retailers:

- don’t have a subsidiary or a branch in any EU Member State, and

- keep ownership of the goods when delivered in Europe

- They will need an indirect representative for customs purposes.

2. Case studies: The pros and cons of importing and trade in France, The Netherlands and Belgium as a non-resident retailer

France

Pros:

- VAT registration: UK businesses can register for VAT directly as a non-resident without the need to appoint a Fiscal Representative

- Import VAT:

A UK retailer that wishes to carry out import operations in France will have to ensure:

- They have a French VAT number and

- That the French VAT number is subject to the “normal real” tax regime for VAT purposes

Under these conditions, French import VAT will be automatically reported on the French VAT return, applying the reverse charge, avoiding any adverse cash flows (depending on the importer’s right to recovery).

Cons:

- Check and set up the French VAT number prior to the first import of goods into France

- Language barrier might apply.

The Netherlands

Pros:

- VAT registration: UK businesses can register for VAT directly as a non-resident without the need to appoint a Tax Representative. Read on for our tip about import VAT

- Import VAT:

UK Retailers can choose to appoint a Tax Representative (General Fiscal Representation) to benefit from the Article 23 License.

This License allows companies to defer payment of import VAT, avoiding any adverse cash flows (depending on the importer’s right to recovery).

Cons:

- A bank guarantee/bond is required to appoint a Tax Representative. A bank deposit is an alternative but, depending on the amount, this might not be feasible.

- Language barrier might apply.

Belgium

Pros:

- VAT registration: UK businesses can register for VAT directly as a non-resident without the need to appoint a Tax Representative.

- Import VAT: UK Retailers can choose to appoint a Tax Representative to benefit from the License ET 14,000. This License allows companies to defer payment of import VAT, avoiding any adverse cash flows (depending on the importer’s right to recovery).

Cons:

- A bank guarantee/bond is required to appoint a tax representative. A bank deposit is an alternative but, depending on the amount, this might not be feasible.

- Language barrier might apply.

3. Timescale for obtaining a VAT number

France

- Direct Registration: Document wise the procedure is not overly complicated.

The difficult part is access to the French portal. Once the French VAT number is issued and a request is made to access the portal, delays can occur waiting for the access code to arrive by post.

Additionally, French Tax Authorities require a SEPA (Single Euro Payments Area) mandate to be created.

- Timing: the process can take 8-12 weeks from submission of the documentation. However, even if the French VAT number is issued, this doesn’t guarantee the possibility to submit the French VAT Returns (i.e. portal access to be received).

Netherlands

- Tax Representative: The UK Retailer must apply for a VAT number. Once issued, the Tax Representative request will be approved.

Then the UK Retailer will have to submit the bank guarantee/bond and once done, an Article 23 License can be issued.

- Timing: the process can take many weeks. The actual issuance of the VAT number can take 6-8 weeks from the submission of the documentation. Further weeks are required to finalize the Article 23 License.

Belgium

Like the Netherlands.

4. VAT Compliance: which returns are required?

France

- VAT Return: In general, it’s filed monthly. In the second year, depending on the activity and estimated turnover, the frequency could become quarterly upon request.

- Further returns (e.g. EC Sales Return, Intrastat return) might be required.

Netherlands

- VAT Return: In general, it’s filed quarterly. On request, the tax return can be filed monthly or annually.

In cases where VAT returns are repeatedly overdue the tax authorities can force the business to file VAT returns monthly. - Further returns (e.g. EC Sales Return, Intrastat return) might be required.

Belgium

- VAT Return: In general, it’s filed monthly. If the taxpayer has an annual turnover below €2,500,000 (VAT excluded), the frequency might be quarterly (some conditions apply).

- Further returns (e.g. EC Sales Return, Intrastat return, Client Listing) might be required.

Final comments

a) France: a new potential contender to the podium as an export country?

As mentioned, France was the 5th largest export market in 2021 even though it’s the closest country geographically to the UK.

In case UK retailers were importing in the Netherlands (3rd) or in Belgium (8th) to benefit mainly from the import VAT deferment schemes, it’s worth considering the possibility of benefiting from this year of the mandatory reverse charge in France.

The above will reduce your obligations (appointment of a Tax Representative) and, more than likely, your compliance costs.

In addition, logistic aspects and where your customers are located play a key role in any decision.

b) Expand your business and benefit from the available tools

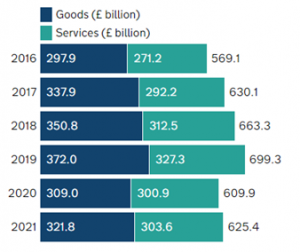

In 2021 the number of goods exported from the UK was £321.8 bn.

Between 2019 and 2020 there was a significant reduction in exports, more than likely connected to the uncertainty created by Brexit.

However, if we consider the trend of the period May 2021 – May 2022, we can notice a positive increase (£343.8 bn).

Therefore, it looks like UK companies are becoming more confident and starting to again focus on cross-border trade. Only time will tell if UK companies in 2022 will exceed the record of £372 bn exports made in 2019.

Published 13/09/2022