By Ellie-Rose Davies, Content Executive at IMRG

In this blog, we reveal why beauty brands are seeing more success when selling online than other product categories and, with the help of industry experts, we give advice for retailers who want to experience similar growth.

Read on to find out more on:

• Beauty stats and figures: Online revenue, and Conversion, ABV, and AOV.

• Top trends to accelerate growth: Offering exclusive benefits to customers, Reducing decision fatigue, and Using online marketplaces.

• Optimising the post-purchase experience: Harvey Nichols’ shipping transformation, Beauty Pie’s in-house fulfilment success, and Post-purchase engagement and customer loyalty.

Beauty stats and figures

Online revenue

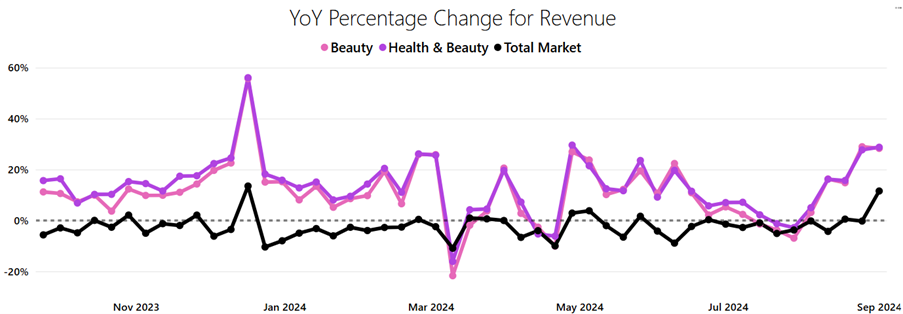

IMRG tracks the performance of various online retail product categories, and beauty has consistently been the top performer. For instance, in the last 12 months, beauty has, for the most part, been well above the industry average growth rate (see chart).

The total market experienced a big uptick in revenue in the week commencing 1st September 2024, at +11.6% Year-on-Year (YoY). When looking at the category split, it was clear that beauty was one of the main drivers for this growth, with an astonishing figure of +28.3% YoY.

Source: IMRG’s Online Retail Index

We can anticipate that growth will continue in the next few weeks as beauty retailers begin to release their annual Christmas calendars.

Tradebyte’s Head of Corporate Relations, Alexander Otto, comments on why beauty brands are seeing more success in 2024; ‘Our recent research with Retail Economics shows that health & beauty has overtaken apparel to become a top three exporter to the EU in non-food retail since Brexit, seeing a 5% increase in 2023 compared to 2019.’

Alexander says, ‘The industry was less affected by Brexit due to fewer policy changes for cosmetics production, meaning that UK beauty businesses were largely already compliant. So, beauty brands have had fewer hurdles to jump than other sectors in recent years, but they have often also been more successful in their attempts to go DTC, helping them tell their stories and build a relationship with their target market.’

‘Social media and live shopping have helped to bolster sales activities,’ notes Alexander, ‘while the growth of subscription and replenishment services also allows beauty brands to ensure repeat business where fashion might struggle.’

Conversion, ABV, and AOV

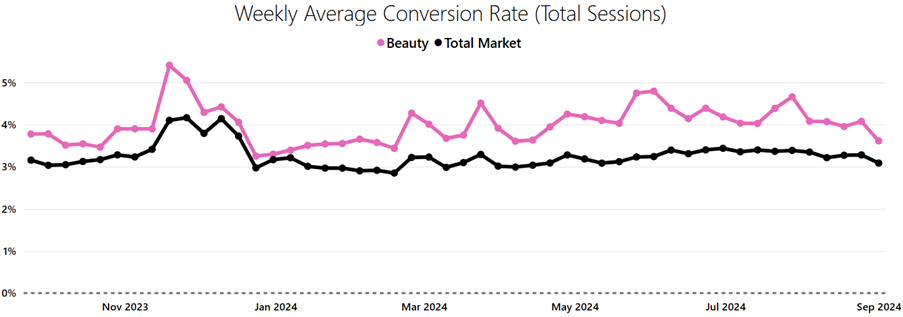

Conversion rates have also been higher for beauty retailers than the industry average (see second chart). There are several reasons for this, such as beauty retailers having lower average basket values than other product categories, showing that the price point is attractive to customers.

Source: IMRG’s Online Retail Index

But there are ways for retailers to increase their average order value!

Dan Bond, VP of Marketing at RevLifter also notes that ‘Beauty products typically have a lower AOV than other categories, making purchases easier. Consumers often add an extra lipstick or moisturiser to their cart without hesitation, boosting overall sales.’

He adds, ‘Many beauty brands also manufacture their products, allowing them to maintain strong margins. This financial flexibility enables them to offer discounts and promotions without significantly impacting profitability.’

‘Brands like Wet n Wild excel at using on-site promotions to increase conversions and AOV. For example, they implemented reactive overlays and exit-intent offers to keep customers engaged and drive sales, effectively reducing cart abandonment.’

Dan explains that ‘Beauty products are great for cross-selling, with low-value items like lip balms or travel-sized products commonly added to increase basket size. Wet n Wild’s “Stretch & Save” promotions incentivised larger purchases, raising their AOV by 25%.’

Top trends to accelerate growth

Offering exclusive benefits to customers

Many successful beauty retailers provide their customers with benefits that would make them more likely to convert and push them to continue their shopping journey beyond the ‘add to bag’ stage

VP of Sales, EMEA & APAC at SheerID, Francois Rychlewski shares that ‘Beauty brands in multiple categories are tapping into the power of exclusive offers for specific communities. These brands are known for making their shoppers feel special, and gated, exclusive offers are a great extension of this.’

‘Brands like Origins, Clinique, Estee Lauder, Tarte and Mac Cosmetics are all using this approach effectively with college students,’ says Francois. ‘While this community is very interested in beauty and self-care, they are often financially challenged. A college student offer provides the beauty brand an opportunity to build an early relationship that can generate full-price returns when the student graduates and starts their career.’

Francois exclaims, ‘In a recent study polling 1761 GenZ consumers, 80% reported that these offers make them more likely to try a brand for the first time, and 7 in 10 reported they are more likely to join their loyalty programme.’

Reducing decision fatigue

Often beauty retailers sell a wide range of products, which can significantly increase decision fatigue among customers. It has become increasingly important to help customers during their purchasing journey to make decisions more quickly, helping to reduce bounce rates.

Bethany Fulton-Wise, Shopify Developer at Brave The Skies, part of the Dark Matter Commerce group reflects on this; ‘The beauty industry thrives in eCommerce, and as a former beauty journalist turned Shopify developer, I’ve noticed key trends. Successful beauty brands like Charlotte Tilbury and Rare Beauty excel by aligning their branding with their customer base, making them instantly recognisable and trustworthy.’

‘Beauty consumers are well-informed, and many brands use interactive tools to simplify shopping. Rare Beauty’s shade finder, Beauty Pie’s skincare quiz, and Violette FR’s augmented reality lipstick try-ons are just a few examples of how these brands reduce decision fatigue.’

‘Additionally,’ says Bethany, ‘subscription services like Hey Estrid’s razors and Fenty Beauty’s Replen + Save program keep customers loyal and returning by taking care of the administrative elements of purchase, saving time and cognitive load for the user.’

Using online marketplaces

Many beauty brands are growing their presence with online marketplaces, which can help attract a whole new customer base.

Simon Dyer, Regional Vice President, UK & Nordics at Mirakl says, ‘The beauty sector has shown strong online performance over the past year with many beauty brands making significant investments in eCommerce.

‘Superdrug, for example, has made a strategic decision to launch a marketplace, to offer an efficient and flexible way to boost online sales. Marketplaces allow brands to swiftly respond to trends and diversify their offerings with new and seasonal products, as well as offering extended ranges, such as colour and size options, without increasing inventory risks,’ shares Simon

Simon continues, ‘Superdrug understood the benefits of this strategy when launching its marketplace in November 2022, and in only 4 months were offering a 40% increase in the number of third-party products available. Additionally, at the end of 2023, Superdrug reported an impressive +11.8% increase in annual sales growth.’

Optimising the post-purchase experience

Harvey Nichols’ shipping transformation

James Henry, Head of Multichannel Operations, shared how Harvey Nichols revamped its delivery strategy. Initially, the brand faced challenges with its next-day delivery service, particularly with small items like lipstick, where the delivery cost outweighed the product value.

The issue came to a head when Harvey Nichols launched Fenty by Rihanna. It required shipping that would automate carrier allocation based on product dimensions and therefore save costs and, because it had already launched Fenty, this needed to happen quickly.

This change, helped by nShift, improved both customer experience and operational efficiency. ‘If an item fits in envelope-sized packaging, it can be sent on a next-day track-to-letterbox service, which means customers no longer need to wait in.’

Additionally, Harvey Nichols has sped up its delivery process by shipping products directly from stores rather than distribution centres – something it was unable to do previously. James says, ‘The payback from the initial project was less than six months… with approximately 20-30% of our parcel volume now via the new letterbox service, we have seen substantial savings.’

Beauty Pie’s in-house fulfilment success

Gavin Murphy, CMO at Scurri, explained how Beauty Pie enhanced its customer journey by taking fulfilment in-house.

‘Its model of selling products from third-party labs, cutting out the middleman… using the same high-quality raw materials as bigger brands, allows it to create affordable and effective luxury ranges,’ says Gavin. This approach led to lower price points, encouraging more frequent shopping and fostering customer loyalty.

‘Beyond its compelling product ranges and pricing strategies, Beauty Pie understands the absolute need for getting its delivery offer right to maintain customer satisfaction and loyalty,’ shares Gavin. ‘By bringing their delivery function in-house, Beauty Pie has complete control and oversight of this critical element of the customer journey.’

‘With effective delivery management, Beauty Pie are adding carriers easily and setting shipping rules to manage its logistics network more efficiently, leading to a marked improvement in its order processing and delivery speed. It has also experienced cost savings, better carrier rates and improved system reliability.’ ‘Ultimately,’ says Gavin,’ all these factors enable Beauty Pie to continue to offer an unrivalled experience to its shoppers globally.”

Post-purchase engagement and customer loyalty

Nick Bareham, SVP of Global Sales at parcelLab, emphasised how beauty brands excel in post-purchase engagement by fostering long-term customer relationships.

He argues that ‘Many beauty brands excel in online retail because they’ve mastered the post-purchase experience, turning a transaction into a relationship. By focussing on personalised communications, targeted offers and seamless returns, these brands are not just meeting customer expectations but exceeding them.’

Nick says, ‘For example, retailers can use tailored post-purchase content and loyalty programmes to keep customers engaged and coming back. Other retailers can learn from this by exploring post-purchase engagement strategies that build loyalty and enhance customer satisfaction. Boosting revenue doesn’t end at checkout – it’s about creating an ongoing and engaged feel-good customer journey that drives repeat business.’

Want to read more? Here are some other IMRG blogs that cover a range of eCommerce topics:

The New Retention Reality: Why You Need to Go Beyond Email in 2024 (and How) – IMRG

Join The Responsible Consumption Revolution – IMRG

Why Multichannel Retail Is Essential For Success In 2024 – IMRG

Ecommerce for Niche Markets: Strategies and Success Stories – IMRG

Mastering Mobile Commerce: Enhancing Apps, UX, and Conversion Strategies – IMRG

To get on-demand beauty insights, check out IMRG’s Digital Dashboard. IMRG members can benchmark their online retail performance across a variety of metrics.

Published 20/09/2024