By Omnia Retail

Black Friday has long been a major event for eCommerce retailers. But the landscape is changing, particularly after the Omnibus ruling in 2023, which has driven retailers to rethink their pricing strategies.

In this blog, we’ll explore key trends from our recent analysis of 40,000 products, highlighting what eCommerce retailers and brands are doing before and during Black Friday to manage pricing and maximise profits.

The early start to Black Friday discounts

A noticeable trend in recent years is the early launch of Black Friday discounts. Industry experts such as IMRG have documented this trend year after year, where Black Friday is no longer just one day, but the entire month of November, and even parts of October and December.

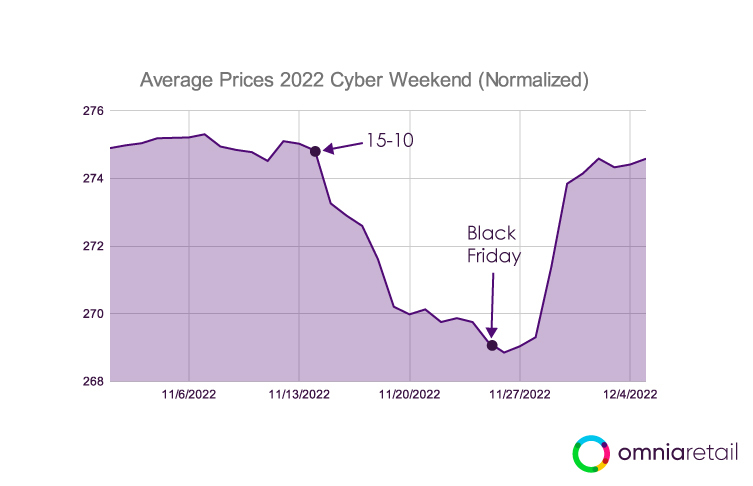

Rather than waiting for the day itself, many retailers begin their promotions up to 10 days before. This tactic aims to capture early shopper interest and spread the purchasing window across a longer period.

While significant discounts are still reserved for Black Friday, the weekend that follows often sees even steeper price cuts—especially on Saturday—as retailers push to clear stock and maximise customer acquisition before campaigns end.

These heavier Saturday discounts reflect a highly dynamic pricing landscape, where prices are adjusted in real-time based on factors such as demand, competition, and stock levels.

We anticipate that for Black Friday 2024 and beyond, more retailers will optimise their pricing strategies in response to market movements, ensuring they remain competitive while protecting profit margins.

By closely monitoring the market, retailers can better decide how long to run their campaigns and ensure their discounts aren’t overly generous.

For example, if a retailer offers a branded top at 50% off while competitors are only offering 20% off, they could adjust their discount to be closer to market levels, e.g., 25% off.

Price-sensitive customers who compare deals across sites may still be likely to choose retailers even with a slightly better offer.

Post-Cyber Monday price changes

After Cyber Monday, prices tend to stabilise, returning to levels seen about two weeks prior.

However, these pricing declines don’t last long— typically, prices gradually decline again in the run-up to Christmas as retailers aim to capture early shoppers.

With dynamic pricing software, retailers can be aware of when their prices should start to decline, preventing the early termination of Black Friday campaigns that can be detrimental to revenue growth.

Timing pricing changes is important because if a customer sees that a retailer does not have good deals when other retailers do, it may make them more hesitant to check out their offers in the future, opting to check competitors first.

Before Black Friday, many retailers stop price decay, which is the natural price reductions that occur over time, so that the discount seems substantially more impressive.

Once these discounts are applied and the sales event ends, retailers tend to return to regular pricing and focus on new stock for the upcoming season. This trend most obviously occurs around mid-January.

Promotions post-2023 Omnibus ruling

Before 2023, many retailers inflated prices in the weeks leading up to Black Friday to create the illusion of deeper discounts.

But, following the Omnibus ruling, which increased transparency around promotional pricing, retailers have had to become more selective with their discounting.

As a result, there now tends to be fewer products on promotion, and the discounts that are offered tend to be more genuine, reflecting actual market value.

Another thing to note is that customers are increasingly more in tune to which brands are ethical and care for their customers.

If a customer feels that they did not get a good deal during Black Friday, they are likely to experience buyers’ remorse, where research showed that 60% of Gen Z regretted buying at least one Black Friday purchase in 2023.

Consequently, these customers may not engage in positive word of mouth or repeat custom with that retailer.

With the Omnibus ruling, retailers are making their pricing strategies more data-driven. Monitoring competitors’ pricing and understanding market trends are helping many to have compelling promotions without misleading customers or falling foul of new regulations.

Black Friday as a key opportunity for end-of-life products

Black Friday is a prime time for retailers to clear out End-of-Life (EOL) products, particularly in the electronics sector.

As new models are released and technology advances, older products tend to lose demand and value. Black Friday offers an ideal moment for retailers to shift this older stock while making room for the latest releases.

Retailers can monitor prices to get a clearer understanding of which products may be nearing EOL. This, alongside knowing well in advance when new products are launching, allows them to time promotions on soon-to-be EOL items more efficiently.

By having attractive discounts on EOL products, retailers create a sense of urgency and perceived value for customers, many of whom are looking for a deal without necessarily needing the latest products.

During Black Friday, many customers are more price-sensitive and willing to purchase slightly older models, especially when the price difference between the current and previous generation is significant.

By positioning these EOL products as great value buys, retailers can move large volumes of stock before demand for these items wanes entirely.

To conclude

It is evident that pricing strategies are becoming increasingly important in eCommerce, particularly around busy trading seasons such as Black Friday, Christmas, and the new year.

With dynamic pricing software, retailers are becoming more intelligent with their promotions, enabling them to grow profits and reduce margin erosion.

Price monitoring can also help retailers anticipate where to place their discounts and sell excess stock, which is particularly beneficial for end-of-life products.

With Omnia’s price monitoring software, you can stay ahead by easily tracking your competitors’ prices. Not only from all the major marketplaces and comparison shopping engines, but also directly from their website to get the full picture of their product prices.

As a valued partner of IMRG, Omnia offers IMRG members a free ‘strategy session’ or consultation call to reflect on your pricing setup and strategies for the holiday season or beyond. You can book a free call here.

Published 04/10/2024