By Ellie-Rose Davies, Content Executive at IMRG

As consumer sentiment improved towards the latter half of the year, Black Friday week (Mon-Cyber Mon) experienced an unexpected +3.1% Year-on-Year (YoY) increase, against IMRG’s initial -1% YoY forecast. The week revealed significant trends which we will cover in this blog:

- Shifts in daily shopping behaviour, with Sunday outperforming Black Friday

- Smarter promotions and pricing strategies driving stronger results

- Longer campaigns transforming Black Friday into ‘Black November’

- Operational challenges amidst record-breaking volumes

- Marketplaces disrupting traditional sales with ultra-affordable products

Shifts in daily shopping behaviour

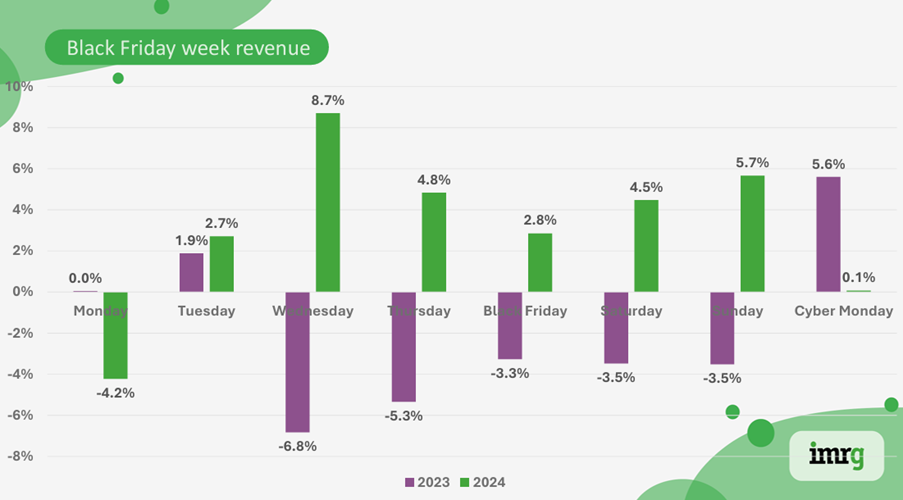

The daily revenue split this year was interesting:

While Wednesday emerged as the top-performing day, this was set against a notably poor performance last year, effectively balancing the data out.

More strikingly, Saturday and Sunday outperformed Black Friday itself, suggesting that UK customers were making the most of the weekend and more free time to do their post-pay day shopping.

As noted by Ellie Morgan, Digital PR Manager at NOVOS, ‘Black Friday 2024 was a record-breaking event for many of our clients, but interestingly, the actual day wasn’t the biggest for most.’

She says, ‘While Friday saw significant sales, the largest spike often came on the Sunday following Black Friday. This suggests that while Black Friday is busy, shoppers may feel overwhelmed by sales, and many delay their purchases.’

Also, Head of SEO at NOVOS, Tom Gandhi shares that this delay in uplift was due to ‘High numbers of customers landing on site in the run up to the BFCM weekend clearly looking for deals to go live, but not converting.’

Ellie continues, ‘Since sales were extended over a week, shoppers took advantage of the quieter Sunday to browse and buy,’ reveals Ellie. eCommerce brands should consider this shift in consumer behaviour when planning their marketing strategies for next year to maximise sales.’

For three years running Cyber Monday has experienced Year-on-Year (YoY) growth. Interestingly, Gavin Murphy, CMO of Scurri reveals that data from their platform ‘showed that Year-on-Year, online sales volumes for the Black Friday Cyber Monday (BFCM) period was up by +33%, with Cyber Monday outperforming an already buoyant Black Friday, with the number of items purchased rising significantly, up +78% on Cyber Monday compared to Black Friday.’

Gavin exclaims, ‘While we saw the same trend of Cyber Monday delivering the largest jump in online orders during the discounting weekend in 2023, this was even more marked this year. With consumer caution and spending decisions being carefully considered, shoppers were holding out to the very last moment to convert to secure the best prices.’

Offers, pricing, and promotions trends

Smarter promotions drive better results

Smarter promotions and strategies around pricing tend to equal better results.

Dan Bond, VP of Marketing at RevLifter, shared insights on how retailers optimised promotions to drive stronger results this year – ‘Black Friday 2024 saw RevLifter retailers using smarter targeted promotions to drive better results.’

‘Stretch-and-save offers boosted AOV by encouraging shoppers to hit discounts or free shipping thresholds. Exit-intent campaigns also proved crucial, re-engaging hesitant customers with additional discounts and saving potential lost sales,’ says Dan.

‘Promoting bestsellers was popular in many campaigns, reducing decision fatigue and driving conversions by spotlighting what others were buying. Some of our customers eschewed Black Friday-specific promotions altogether but still used intelligent offers through the funnel to accelerate performance over the busy period.’

Claudia Poole, Senior Performance Marketing Manager at ASK BOSCO, highlighted how affiliate strategies performed during Black Friday:

‘Retailers focused a lot on ‘early access BF’ and pushed messaging through voucher and content sites that offers wouldn’t get better on Black Friday. Whilst this did encourage early November orders, most shoppers were waiting for Black Friday to convert, using the start of the month to browse and shop around.’

‘Cashback sites were providing extremely high purchase incentives with cashback rates of up to 20% and monetary bonuses for higher AOV purchases, particularly for brands who didn’t have high discounts on site.’

‘With all the noise around Black Friday and the promotions on offer, CSS partners who were tailoring their strategy in line with retailers saw a spike in performance due to increased search volume and purchase intent,’ shares Claudia.

Smart pricing strategies can bring growth

Strategic pricing emerged as a cornerstone of success for Black Friday 2024. Hemang Nathwani, Sales Director at Price Trakker, highlights how ‘crucial data-driven pricing is for both retailers and brands.’

Hemang explores how ‘Many retailers experienced better campaign performance thanks to real-time market analysis. At the same time, brands were able to keep an eye on their product prices across the market, spotting deep discounters and protecting their brand reputation.’

‘From our perspective, personalised promotions and well-optimised pricing not only drove sales but also built stronger customer loyalty.’

‘Looking ahead to 2025, retailers will benefit from solid pricing analytics to quickly respond to market shifts and consumer behaviour, ensuring they stay competitive not only during the peak trading period but throughout the year.’

Also pricing experts, Prisync, emphasise that ‘Black Friday 2024 highlighted the importance of strategic pricing in driving sales, with consumers spending $131.5 billion from November to December 2nd, 2024 (Adobe).’

‘Despite month-long discounts, the largest deals occurred during Black Friday, appealing to budget-conscious shoppers. A standout trend was the rise in BNPL (Buy Now, Pay Later), facilitating $9.4 billion in purchases and showcasing a shift toward flexible payment options.’

‘Additionally, purchases made on mobile accounted for $69.8 billion, emphasising the need for mobile-friendly online stores to capitalise on the traffic. Another year and competitive pricing strategies based on competitors’ prices remain the cornerstone of success.’

Longer campaign durations and changing strategies

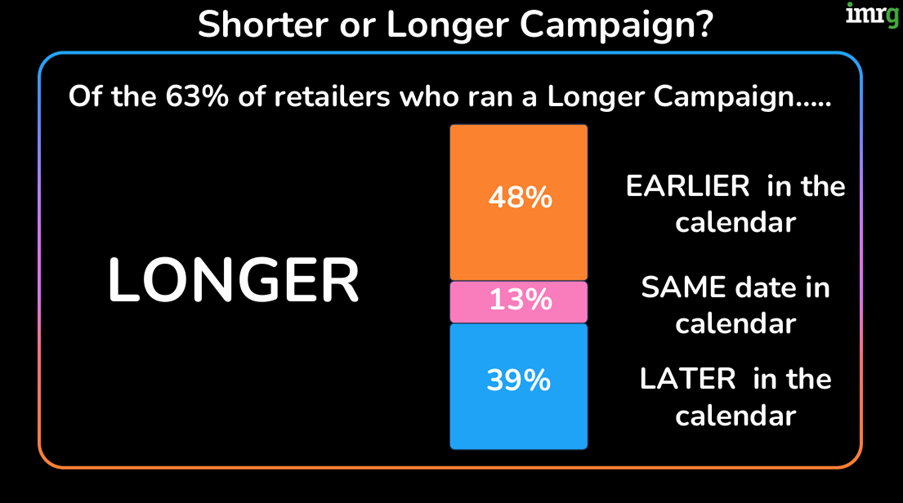

IMRG’s Black Friday tracker revealed that 63% of retailers extended their Black Friday campaigns this year.

Nearly half (48%) started earlier in the calendar, while 39% ran campaigns later, with an average campaign length increase of +6 days. This trend underscores the growing perception of Black Friday as a month-long event— “Black November”—rather than a single day.

What about the creativity behind these campaigns?

Cris Chen, Performance Marketing Manager at ASK BOSCO says, ‘Retailers used visually engaging content to attract shoppers and boost brand awareness.’

‘Shoppable ad formats proved highly effective, allowing viewers to click directly to purchase. This approach drove strong conversion rates, with some industries reporting a 25% increase compared to 2023.’

Chris exclaims, ‘Videos blending promotional content with authentic storytelling resonated strongly with audiences, driving higher view rates and engagement.’

‘The use of ad sequencing kept audiences engaged throughout the customer journey. Additionally, brands experimenting with shorter, punchy video formats saw improved performance across key metrics.’

Operational Insights: Meeting customer demands

Operational preparedness remains critical during Black Friday.

According to PayPoint, ‘Collect+ data revealed a +28.2% increase in parcels processed this year compared to the same time period during Black Friday 2023, highlighting how shoppers made the most out of deals in the run up to Christmas.’

‘In addition, 1.6 million parcels were processed for returns over the Black Friday period. Not only does this illustrate the high volume of parcels, but also the intense demands on retailers during this busy time. Core preparations such as sufficient staffing and inventory reporting were key to ensuring success.’

‘Retailers should make note of the challenges they faced this year and, where possible, gradually implement changes to their operations over the coming months to improve processes long term and avoid a last-minute rush in 2025.’

Paul Taylor, COO at fulfilmentcrowd, highlighted the growing need for flexibility and speed in eCommerce:

‘Retailers who embraced data-driven forecasting and agile fulfilment stood out, ensuring seamless experiences for customers despite record-breaking order volumes.’

‘This year, we saw a surge in consumer interest in sustainable options, with eco-friendly packaging and carbon-neutral deliveries becoming differentiators.’

‘For 2025, the key is scalability – leveraging smart fulfilment networks and adaptive technologies to meet rising expectations. One standout trend was the integration of personalised marketing with real-time stock availability, which drove conversion rates significantly. Retailers can align operational capabilities with consumer preferences to build lasting loyalty.’

Gary Carlile, Executive VP of Customer Growth at nShift reflects on effective planning for increased demand; ‘Often the short, sharp sales spike can leave retailers facing a capacity crisis.’

‘Our own data suggests that retailers have to scale up to almost double the usual delivery capacity to meet Black Friday demand. It’s something we’ve seen play out in reality with one courier company making headlines after finding it lacked the capacity to complete deliveries,’ reveals Gary.

When demand rises, Gary says having access to a large network of carriers is useful – ‘Not only does this allow businesses to scale up, but it also enables retailers to offer a greater range of delivery options to customers.’

Steve Warrington, SVP of Client Industry & Engagement at Upp.ai, also noted the shift towards AI-led strategies.

He says, ‘In the battleground of Google’s Shopping carousel, many retailers who leveraged AI achieved stronger results by focusing on strategic inputs rather than micromanagement.’

‘Success for many came from prioritising flexibility – allowing the AI to respond swiftly to trends such as shifting audience intent and high-demand SKUs. In our view, Black Friday 2024 set a new standard as trust in AI continued to grow.’

Also, a clever strategy to have in place is composable commerce, which Daisy Cranfield, Senior Marketing Manager at Commercetools can ensure ‘100% uptime and lightning-fast response times during peak traffic.’ With composable commerce, retailers can ‘innovate, adapt, and thrive year-round.’

Marketplaces and the competitive landscape

Alexander Otto, Head of Corporate Relations at Tradebyte explores how ‘Consumers no longer feel compelled to wait for holiday discounts when marketplaces such as Shein and Temu provide bargains daily. While they lack some major brands, their rapid growth and onboarding rates suggest this may shift by 2025, further disrupting the retail landscape.’

Alexander says ‘This absence may have bolstered premium brands this year as shoppers turned to Black Friday for quality deals. The competitive pressure has also driven innovations like Amazon Haul in the US, signalling a response to Shein and Temu’s dominance and hinting at future retail transformations to come.’

Simon Dyer, Regional Vice President, UK & Nordics at Mirakl says marketplaces have a ‘pivotal role in driving retailer success during Black Friday 2024.’

‘Due to the stock-light nature of the model, businesses can rapidly diversify their offerings and meet consumer expectations, even in challenging economic conditions.’

Simon noticed ‘Achievements were driven by key categories such as Electronics and Home Essentials, reflecting consumers’ focus on practical, high-quality products in response to inflation.’

So, what have we learned?

Black Friday 2024 reinforced the importance of adaptability, smarter promotions, and strategic pricing. From extended campaigns to operational innovation and the growing influence of marketplaces, many retailers who embraced these trends achieved strong results.

Keep an eye out for our Black Friday 2024 report that is set to release in January – if you would like a reminder to download, reach out to us via LinkedIn and we will make a note to sent it to you once it’s live. The report will feature ALL of IMRG’s findings from the peak period.

Published 17/12/2024