By Alexander Otto, Head of Corporate Relations at Tradebyte

Since January 31st 2020, when the UK officially left the EU, the UK retail industry has undergone significant transformation. The controversial decision in favour of Brexit following the 2016 referendum has reshaped the rules of international trade between the UK and mainland Europe – to the detriment of UK brands and retailers seeking growth outside of the domestic market.

For many British businesses, the path to expansion is now fraught with challenges. The additional red tape incurred by the country’s withdrawal from the EU has made it considerably more difficult to tap into the EU’s lucrative eCommerce market.

These challenges include higher logistics and export costs, complications in registering for an EU entity for trading, and significant delays amidst an already competitive and intensified environment characterised by tight profit margins and the need to respond quickly to the latest trends.

More significant challenges, fewer sales

A new research report we’ve conducted in partnership with Retail Economics reveals the heightened challenges facing UK retailers in the wake of Brexit. It has constrained growth opportunities by introducing many challenges for UK brands and retailers selling in the EU.

Increased customs paperwork, including complex declarations, VAT intricacies, and evolving product regulations, slow down exports and elevate operational costs significantly, for example. Meanwhile, a shortage of expertise in customs compliance, international trade regulations, VAT management, and the additional complexities of securing visas for low-paid retail workers creates operational bottlenecks, hindering smooth cross-border trade.

The potential requirement for VAT registration across multiple EU countries, coupled with upfront financial guarantees, strains resources and poses financial risks for brands and retailers, especially SMEs. Shifts in regulatory standards between the UK and the EU introduce compliance complexities, such as varying product standards and safety regulations, necessitating careful adaptation and additional resources for compliance.

Uncertainties surrounding border procedures, customs checks, and regulatory compliance have disrupted supply chains, leading to delays, shortages, and increased transportation costs for UK brands and retailers sourcing materials or products from EU suppliers.

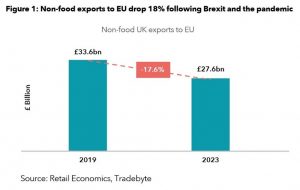

The impact of these challenges is stark. UK retail sales to the EU have plummeted by a staggering £5.9 billion since 2019. This is a significant loss, particularly when considering the potential of the thriving European eCommerce market. The online retail sector alone is estimated to contribute £323 billion of annual sales to EU economies, a potential that UK-based brands and retailers are currently unable to fully tap into due to additional trade frictions.

Varying impact on retail categories

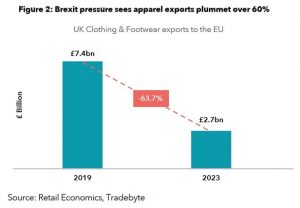

Interestingly, these impacts are being felt unevenly across retail categories. The value of non-food exports has dropped almost a fifth (18%) since Brexit, with clothing and footwear faring the worst. Exports in this sector have fallen 64% from £7.4 billion in 2019 to just £2.7 billion in 2023– almost two-thirds.

While apparel pre-Brexit was a top three non-food retail exporter, Health & Beauty, Electricals, and DIY & Gardening now makeup three-quarters of UK retail exports to the EU. Health & Beauty and DIY & Gardening are the only two categories with a marginal increase in export values since 2019.

Clearly, the new trading relationship with the EU has shifted dynamics, with fashion at the greater mercy of economic changes, given its constant need to adapt to changing styles and trends.

This sharp drop has put considerable pressure on brands and retailers lacking the necessary expertise, resources, or financial capacity to navigate the complexities of the new regulatory landscape.

Seizing the marketplace lifeline

Despite the major disruption caused by Brexit for UK brands and retailers who now must navigate increased friction and cost, digital marketplaces have emerged as an opportunity to tap into the EU market and expand into new territories. Representing over two-fifths of the EU’s £322.6 billion annual online non-food sales, they offer a path to access affluent and younger consumer demographics and tunes into mass technological adoption.

Offering established paths and valuable market insights, marketplaces can serve as gateways for international expansion for UK retailers looking to mitigate the impact of Brexit. They can help navigate complex logistics and regulations, provide localisation support, and enable strategic assortment differentiation.

Marketplaces also play a pivotal role in enhancing digital experiences for both sellers and buyers, harnessing technology such as AI to add value and improve operations. Moreover, marketplaces are becoming central hubs for promoting recommerce and sustainability, driving innovation and collaboration across the supply chain to support environmentally conscious consumer choices.

Through marketplaces, retailers can penetrate foreign markets efficiently, minimising the problems of setting up standalone operations. Key areas of support to optimise marketplaces include strong logistics and regulation, as well as efforts to localise propositions. However, we recommend brands to carefully consider assortment mixes to avoid brand dilution or cannibalisation.

Today, marketplace sales alone account for at least £133 billion in EU eCommerce, and the concentration of sales among the largest EU markets means the top 10 online markets account for the lion’s share of non-food online sales.

Facilitating cross-border opportunities

Brexit has undoubtedly reshaped the UK’s retail landscape, presenting significant challenges for brands and retailers aiming to expand into the European market. The increased costs, logistical hurdles, and regulatory complexities have created a formidable barrier, causing a substantial drop in exports, particularly in the non-food sector. However, amidst these challenges, digital marketplaces have emerged as a beacon of hope, offering UK retailers a viable pathway to tap into the lucrative EU market.

Marketplaces like ASOS Marketplace, About You, and Zalando support navigating the new trading environment. They help retailers overcome logistical challenges, comply with regulations, and effectively localise their offerings. These platforms not only facilitate access to a vast consumer base but also leverage advanced technologies to enhance the retail experience, making them indispensable in the post-Brexit era.

As the UK retail industry continues to adapt to its new reality, embracing the opportunities presented by digital marketplaces is being seen as increasingly valuable. By leveraging these platforms, UK retailers can weather the storm of Brexit and become more interconnected in this digital world, marking a new dawn for the industry.

The Tradebyte and Retail Economics report “From Brexit to Breakthrough – Market Expansion for UK Brands” can be downloaded from https://www.tradebyte.com/en/market-expansion-for-uk-brands/#download

Published 09/07/2024