By Ellie-Rose Davies, Content Executive at IMRG

It’s January which means… it’s time to unwrap Christmas trends!

In this blog we will explore what happened during the Christmas peak, helping retailers to identify shifts in trading patterns, customer behaviour, and performance post-Black Friday.

Read on to discover:

- December weekly performance

- Customer demand trends

- Mastering Christmas gifting with early prep and AI

- What’s in-store (or rather, online) for Christmas 2025?

December weekly performance

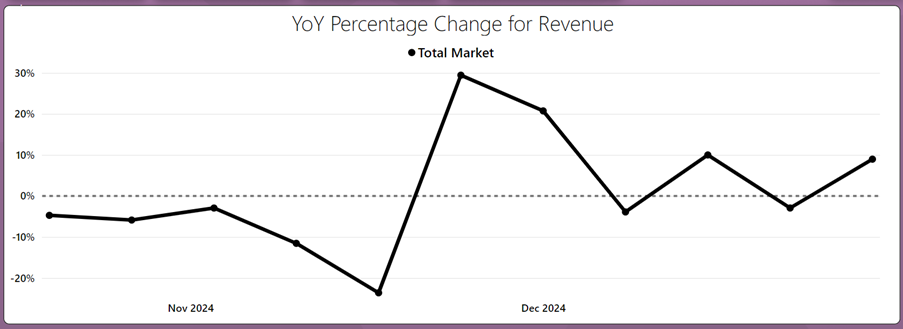

The chart below shows December weekly revenue performance (data furthest to the right), and it reveals an interesting story.

Source: IMRG’s Online Retail Index, Digital Dashboard

The total online market in the first week of December was up +20.7% Year-on-Year (YoY), which may have been a result of Cyber Monday sales falling in this month, triggering early Christmas spending among consumers.

There were two other moments of growth in December, in the w/c 15th December (+10% YoY) and w/c 29th December (+9% YoY). The month overall was up +6.7% YoY, which marks the fourth consecutive month of growth for eCommerce! – November was up +1.4% YoY.

From this data, we can infer, as expressed by Alfie Staples, Senior Global Insights Manager at Awin, ‘This year, it looks like consumers really leaned into Cyber Weekend to get most of their holiday shopping done.’

Interestingly, Awin saw ‘conversion rates plummet by nearly half (-47%) after Cyber Weekend, compared to a smaller drop of -23% last year. This shows a big shift in spending habits, with fewer people intent to convert after the Cyber period.’

One of the metrics that showed improvement in December 2024 was orders. Orders were up +7.8% YoY, whereas in November there was no change (0%).

However – one of the biggest metrics was down: traffic. Despite brief growth in traffic in September, traffic was down in November and December according to IMRG’s Online Retail Index data.

As noted by Georgina Farrow, Client Services Director at Summit, ‘Like Black Friday, brands started sales activity earlier to capture sales, but traffic declines across the board meant lots of retailers were disappointed.’

Georgina found that ‘footfall fell over key trading periods such as Boxing Day.’ IMRG also reported declines in revenue and traffic in w/c 22nd December. Georgina continues, ‘Our clients saw a similar story, with overall traffic down during the Christmas period despite improved CVR and AOV.’

Find out more about December performance with a breakdown of product category trends via IMRG’s Digital Dashboard and our Weekly Data Show.

Customer demand trends

Now it’s time to explore some customer demand trends.

Starting the conversation on this is Lee Thompson, CEO at fulfilmentcrowd. He states, ‘This year’s Christmas shopping peak showed us just how vital agility and scalability are for eCommerce success.’

Lee says, ‘After a record-breaking Black Friday, where we saw a 48% Year-on-Year increase in order volume, it was clear that consumers’ appetite for convenience and speed carried through to Christmas.’

‘However, unlike Black Friday’s focus on deals, Christmas shopping leaned heavily into personalisation and thoughtful gifting. Many retailers who offered flexible fulfilment options, such as express shipping and seamless returns, came out ahead. These trends highlight the importance of adapting fulfilment strategies to customer expectations as we head into 2025.’

It is also important to remember when strategising 2025 that there is increased demand in all areas during and right after the peak trading season, from sending parcels to returns.

Industry experts at PayPoint express that ‘The festive period is a notoriously busy time for eCommerce, particularly when it comes to parcel services. In fact, demand prevailed on Christmas Day itself, with insight from Collect+ revealing that the first parcel return was at 7.06am in Hatfield.’

‘Black Friday also made its mark in 2024, as Collect+ data revealed a +28.2% increase in parcels processed compared to the same time period during 2023, highlighting again how shoppers were keen to make the most out of deals in the lead up to Christmas.’

‘These occasions make clear why it’s important for retailers to be conveniently positioned for customers, especially for any last-minute services.’

Mastering Christmas gifting with early prep and AI

A big trend identified in December 2024 was an increase in the number of retailers who prioritised helping customers with finding the perfect gifts for their loved ones ahead of time.

Emily Long, CEO at Genie Goals says, ‘Brands who have been investing in upper funnel activity ahead of the Christmas period were the winners.’

‘Particularly purchases with a longer consideration phase, brands who got comfortable with a higher COS during the weeks leading up to peak (October specifically) were able to effectively and efficiently retarget these customers rather than compete to get on their radar in December.’

Emily continues, ‘Consumers have never been so savvy, brands can get on those virtual shopping lists early or pay a premium to compete in those peak months further up the funnel.’

‘In 2025 brands should consider how they can get profitable revenue through during Q4 – whether they need to compete as aggressively with promotions during BFCM or focus on getting more profitable revenue through the till in December when the customer is in a more gifting mindset,’ shares Emily

Dan Bond, VP of Marketing at RevLifter has identified smart strategies that helped customers with their Christmas shopping; ‘Retailers who excelled leaned into seasonal product recommendations and upselling opportunities—offering extra gifts for loved ones or clever add-ons.’

‘Campaigns like Stretch & Save built bigger baskets while prominently displaying Christmas delivery cut-off dates spurred conversions. The key was helping customers complete holiday shopping seamlessly while boosting basket size and profitability. It’s about creating value for shoppers and balancing the books for retailers.’

Kevin Laymoun, Chief Customer and Revenue Officer at Constructor says during gifting seasons, ‘personalisation is a standard — and really important — part of a retailers’ toolkit.’

‘However, personalisation may fall a little short. That’s because a shopper’s own preferences (for colours, sizes, brands, and so on) aren’t as meaningful when that shopper is in gift-giving mode.’

‘So,’ says Kevin, ‘in the run-up to Christmas and Boxing Day, we saw retailers lean heavily into generative AI (GenAI) – to aid their online shoppers.’

‘Many retailers began using AI shopping assistants as gift finders. These assistants make online search more conversational – emulating the guidance shoppers might receive from an in-store associate.’

‘Recent data shows that more than 6 in 10 UK shoppers (64%) would ‘definitely’ or ‘probably’ be willing to engage with an AI assistant when they’re unsure what to buy.’

Interestingly, Kevin saw also innovative retailers who ‘began recording their sales associates for custom large language models (LLMs). This is a great way to further humanise AI models and curate winning shopping experiences.’

What’s in-store (or rather, online) for Christmas 2025?

With increased customer confidence (as seen by the trend of four consecutive months of growth in the eCommerce sector after a sustained period of declines), we can hope for a more promising 2025 and another year of growth for December trading.

More retailers may embrace helping customers with their Christmas shopping and subsequently boost online metric performance, e.g., through personalised gifting, tactful offers, and early retargeting.

We might expect retailers to work on improving traffic to their online stores and prioritising strategies to grow conversion rates in the latter half of December.

What do you expect from Christmas 2025?

Published 16/01/2025