By Ellie-Rose Davies, Content Executive at IMRG

The conversation around retail’s busiest calendar event, Black Friday, continues!

In this blog, we’ll explore the key learnings from Black Friday 2023 and outline expectations for online trading this year. We’ll highlight key trends and strategies to help you drive stronger performance.

Here’s what we’ll cover:

- What Happened During Black Friday 2023?

- Focus on customer acquisition and retention

- Maximise impact with smart discounts and offers

- Embrace multi- and omnichannel strategies

- Enhance the post-purchase experience

Each section will equip you with insights and techniques to make the most of this peak trading period.

What happened during Black Friday 2023?

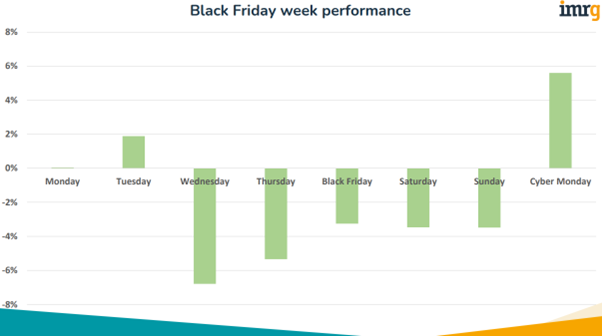

During Black Friday week 2023 (Mon-Mon), online retail saw a decline of -1.9%, precisely in line with IMRG’s forecast of -2%. Cyber Monday proved to be the strongest trading day, with a +5.6% Year-on-Year (YoY) increase, followed by Tuesday, which also showed positive growth (+1.9% YoY).

Black Friday itself faced challenges as not everyone was paid before the event. This year, however, the whole population will have been paid by the Friday (29th), which could boost trading activity. Cyber Monday is also likely to remain stable as retailers capitalise on FOMO (fear-of-missing-out) messaging.

Encouragingly, this year has already shown moments of market growth, whereas 2023’s best performance was flat due to variables such as the cost-of-living crisis. With interest rates beginning to ease, we anticipate reduced buyer hesitancy, and owing to slightly improved conditions, IMRG’s forecast for Black Friday week 2024 is a -1% decline.

Last year, many retailers leaned on exclusivity—such as early access for app members—to attract customers, a tactic we expect will grow this year as brands aim to acquire and retain customers in a competitive market. Promoting app usage has the added benefit of encouraging repeat purchases, while exclusive access helps foster loyalty through a sense of community and reward.

In 2023, the best-performing product categories were Electricals, up +2.7% YoY during Black Friday week, primarily driven by demand for ear pods, and Health & Beauty, which led the way with a +7.6% YoY increase. Both categories also saw growth in 2022. Health & Beauty has continued to show strong growth throughout 2024, making it a likely top contender again this peak season.

Focus on customer acquisition and retention

IMRG has found that customer acquisition and retention are the top focus areas for retailers this year. Black Friday 2024 marks the perfect opportunity to grow in these areas, and industry experts have a variety of recommendations to help.

Tom Pickard, Head of Paid Search at ASK BOSCO® exclaims, ‘The wins for retailers is that customers are starting to spend again after a low spending summer.’

‘With a shorter shopping period this year compared to last year, being the first choice for a customer visit will be key. Retailers that saw the most success last year focused on two key areas; understanding the customer they are trying to win and how they re-engage that customer long term,’ says Tom.

‘Email list sign ups through competitions before Black Friday proved successful in warming people up. Post Black Friday, retailers can create a list of customers who purchased for the first time during the sale and engage with them differently post sale periods, e.g., offers or discount codes”

On the topic of email, Barley Laing, the UK Managing Director at Melissa recommends retailers to use email verification; ‘email verification ensures that future communications will land in that customer’s mailbox, and not be wasted in the “spamosphere.”’

Barley notes that the ‘retailers who had the most success over Black Friday in 2023 recognised that they have “one shot” when a consumer is on their site. If that interaction is slow or complex the consumer will scroll on.’

‘However, if the customer journey is simple and intuitive there is a much higher chance of getting them through checkout, and then possibly repeat business.’

Address lookup can help make the customer journey smoother. ‘It saves customers time when inputting their address by bringing up an accurate, correctly formatted address as they type, and importantly helps retailers capture only verified postal addresses for delivery – the most high-cost risk element of the fulfilment process,’ says Barley.

For James Johnstone, Paid Media Director at Mediaworks, Black Friday success is all in strategic planning. He says, ‘Planning is one of the most important aspects to a successful Black Friday and holiday period, as each year shoppers begin the discovery and research journey’s earlier and earlier.’

‘Having a full funnel strategy which can capitalise on lower CPC/CPM costs throughout October and early November to generate awareness and reach users researching products and prospective deals ahead of peak is very important.’

James also prompts retailers to ensure their ‘campaigns include Friday before Black Friday. “Forgotten Friday” has become the largest sales day of the year outside of the Black Friday Weekend for many, so ensuring campaigns are setup ahead of this date to capitalise on the early market intent can help supercharge your peak period performance.’

Maximise impact with smart discounts and offers

IMRG’s Black Friday tracker data reveals that retailers are increasingly launching discounts earlier each year, a trend we expect will persist into 2024. This year, we have already seen major retailers introduce Black Friday preview messaging (as early as w/c 20th October!), linking directly to products currently on offer.

Though it may be tempting to use the biggest discount to attract early shoppers, industry experts suggest that being smart with your offerings can help boost performance this Black Friday.

According to Dan Bond, VP of Marketing at RevLifter, ‘Black Friday 2023 underscored the importance of dynamic, data-driven offers—like discounts tied to cart value thresholds—successfully encouraging larger orders and helping to manage stock levels effectively.’

Dan says, ‘Those who thrived used personalised promotions triggered by real-time behaviours, such as exit-intent offers that kept shoppers from abandoning their carts to complement their big sales.’

‘In contrast, brands that missed out often relied entirely on blanket discounts that strained margins without strategically increasing spend per customer,’ reveals Dan. ‘For 2024, focussing on fine-tuning offer timing and value based on live customer data will be critical to driving both profitability and conversion rates.’

Industry expert Prisync exclaims, ‘Despite rising inflation, the retailers that thrived last year invested in dynamic pricing, inventory management, and personalised promotions. Strugglers often lacked clear strategies or failed to align discounts with customer expectations.’

‘In 2024, merchants experienced discount days like Amazon Prime Big Deals Day before BFCM. Despite this, BFCM discounts are usually even bigger, so retailers should prioritise analysing their conversion rates, stockouts, and pricing flexibility to identify their strengths and weaknesses,’ suggests Prisync.

Another clever approach is segmenting discounts by customer type. François Rychlewski, VP of sales EMEA & APAC at SheerID says, ‘Brands that created exclusive offers for Black Friday 2023 — deals targeted at specific groups like students or healthcare workers — not only drove immediate sales, they also captured valuable customer data and insights that enabled them to personalise interactions going forward.’

François explains, ‘By continuing to offer relevant, exclusive deals throughout the year, retailers kept those customers coming back, driving repeat purchases and building stronger loyalty. True success goes beyond the Black Friday sales spike — it’s about how well brands keep the momentum going and turn that holiday rush into lasting customer relationships.’

Tom Palin, Team Leader at Awin notes that ‘brands should ensure discount code strategies and on-site pricing are dynamic and competitive. Think offer stacking for Black Friday itself and ensure you outshine the competition at every opportunity.’

‘Brand-to-Brand partnerships are also effective at driving growth and checkout marketing has huge potential. Brands implementing these tend to see an incremental increase of +5% to their conversion rate.’

Also, ‘Affiliate-channel performance for retail clients during Black Friday 2023 exceeded that of traditional eCommerce with revenue increasing +8.8% vs +7.3%.’

Embrace multi- and omnichannel strategies

Retailers that had an easier time during Black Friday 2023 provided a seamless customer purchasing experience across all channels, carefully crafting campaigns for both online and in-store shoppers.

Alexander Otto, Head of Corporate Relations at Tradebyte says, ‘With eCommerce and social media playing a crucial role in driving awareness for Black Friday deals, retailers should couple a multi-channel approach with a seamless, efficient shopping experience across all platforms.’

‘A key factor in an omnichannel strategy’s success is data management. By leveraging customer data to provide a smooth, personalised shopping experience across all touchpoints, retailers can meet customer needs and ensure satisfaction, no matter where they are or what they require.’

‘This omnichannel strategy not only enhances customer engagement, but ensures retailers can meet the growing demand for convenience, speed, and personalisation— crucial factors for a successful Black Friday.’

Chief Strategy Officer at Mediaworks, Andy Blenkinsop, further emphasises how ‘Black Friday 2023 highlighted that retailers investing in seamless omnichannel experiences saw the most success.’

Andy voices how ‘Brands that integrated online and in-store offers, provided fast delivery, and used personalised marketing tended to achieve the highest returns. However, many faced issues with inadequate website performance, leading to crashes and slow load times. To succeed in future campaigns, retailers should focus on data-driven marketing, strong site infrastructure, and pre-event testing.’

Expert PayPoint says, ‘To maximise success this year, stores should reflect on performance from previous years as well as look at other successful retailers for key trends.”

‘With an uptick in online shopping, retailers offering parcel services should also consider their countertop layout and maximise impulsive purchase choices through product placement, as it is likely store footfall will be up during Black Friday for parcel collection and returns.’

Enhance the post-purchase experience

Key learnings from Black Friday 2023 include prioritising the post-purchase experience. This peak trading period isn’t just about securing sales; it’s also time to win lasting customer loyalty by meeting expectations beyond the buy button.

According to fulfilmentcrowd, the key to a successful Black Friday lies in preparedness and adaptability. They say, ‘Retailers who succeeded last year were agile, prepared, and managed demand spikes effectively. Those who struggled typically faced supply chain bottlenecks or underestimated demand.’

‘Our data from last year showed a 35% increase in orders over the Black Friday and Cyber Monday week, driven by businesses that optimised their fulfilment processes and utilised an adaptive strategy.’

‘To repeat this success, retailers can focus on forecasting, ensuring stock availability, and maintaining flexible shipping options to meet customer expectations. Always be prepared!,’ exclaim fulfilmentcrowd.

Johan Hellman, VP Product and Carrier Management at nShift says, ‘Some 84% of consumers agree that a positive experience during Black Friday would encourage them to shop with that retailer again. The challenge then, is for retailers to turn Black Friday bargain hunters into life-long customers.’

‘They can do this by providing an outstanding post-purchase experience covering everything from branded tracking to offering best-in-class return options.’

‘Our own research found that 58% of shoppers would buy again from retailers that deliver purchases efficiently. This means making the delivery experience as compelling and reliable as possible creates real opportunities with those who have clicked the buy button for the first time. Delivering this experience means being able to scale up capacity and offer real choice,’ argues Johan.

Returns play a crucial role in the post-purchase experience. In a recent IMRG report, returns ranked as a top priority for customers, second only to the choice of available couriers.

Marko Kiers, Chief Commercial Officer at ReBound comments, ‘Last year, retailers faced a significant spike in returns after Black Friday, but many missed a key opportunity to draw on valuable insights.’

‘This was due to incorrect returns data – useful information that could have lowered return rates during the rest of peak trading.’

Marko says, ‘In 2023, the reasons given for returns were often inaccurate. Customers had limited returns options, so many items were incorrectly labelled as “didn’t fit”, when the real reason was “delayed delivery” or “damaged items”. Having accurate insight about why items are being sent back can enable retailers and brands to take informed, corrective action.’

‘This year we’re expecting an even bigger spike in returns. Luckily, there’s still time for retailers to improve their returns options ahead of Black Friday 2024. By fine-tuning the reasons for returns, they can create opportunity to capture more reliable and actionable data.’

What were your key learnings from Black Friday 2023? Let us know at one of our upcoming physical or virtual peak-themed events.

Published 29/10/2024