By Ellie-Rose Davies, Content Executive at IMRG

Throughout 2024, Beauty emerged as a top-performing subcategory tracked by IMRG, while Clothing struggled to gain momentum. These trends have persisted into early 2025.

In this blog, we’ll explore the latest trends in these two sectors and share practical growth strategies. Read on to discover what fashion and beauty retailers can learn from each other, and how those managing both categories can do so effectively.

IMRG index data: Fashion and beauty commerce

Fashion trends

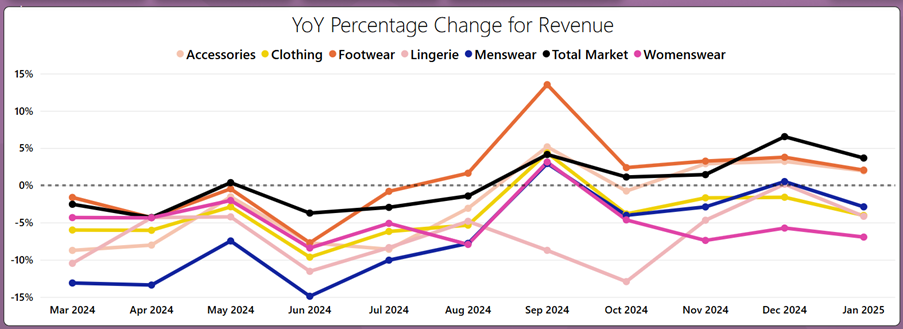

The Clothing sector continues to struggle to gain momentum, with all relevant subcategories experiencing declines in Year-on-Year revenue growth, according to IMRG’s Online Retail Index. Footwear stands as the exception, showing growth in a few months of 2024 and maintaining six consecutive months of growth since August 2024. The category saw a particularly strong peak in September 2024.

Overall, the Clothing sector consistently underperforms compared to the total online market.

Beauty trends

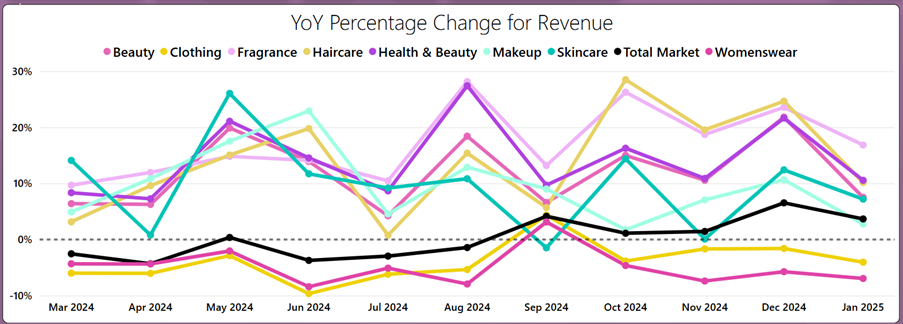

In stark contrast to Clothing, the Beauty sector is performing exceptionally well according to IMRG’s Online Retail Index. Particularly since 2023, Beauty has ridden above the wave of total online market performance. In 2025 thus far, Fragrance and Haircare have been the top performing subcategories of Health & Beauty, but Beauty has also seen substantial growth.

Beauty sector insights

Beauty’s success owes to a variety of factors, from clever approaches to market, to increased customer propensity to purchase such items. Industry experts have revealed below some of the reasons Beauty continues to outperform other sectors.

Social-first and heightened product experiences

Justin Thomas, VP Sales EMEA North at Akeneo, comments that “The beauty industry is renowned for being a pioneering early adopter of social commerce, with TikTok Shop reported to be the second largest beauty and wellness eCommerce retailer in the UK.

‘Regardless of how brands are creating shoppable content – product information still underpins all these interactions. Take for example influencers or brand collabs – these will require a product brief to allow these 3rd party endorsers to be able to create the product-centric, authentic content designed to promote and sell while communicating accurate key product messaging.’

Justin recommends ‘Syncing product information across social commerce channels in real-time, which becomes even more powerful when integrated with pricing and availability data.’

Reinforcing the value of social commerce and ensuring accurate and informative product information is Scott Tehrani, Media Strategy Director at 26PMX. Scott says, ‘Beauty demand is less elastic than clothing. When purses tighten, your skincare routine is the last thing to go, especially in the social age with Vinted bargains. One macro trend I think beauty has adopted more so than fashion is ‘authenticity and transparency.’

Scott notes how ‘Beauty is social first. From make-up tutorials to product comparisons, UGC and influencers dominate social media, and some brands and retailers have carried that over to on-site as well.’

In comparison, ‘You sometimes still don’t understand how clothing will look in real life. Richer product descriptions incorporating micro UX features like model size, UGC reviews, fit runs and video can all remove buyer hesitation.’ Plus, ‘Accessible ABV builds like “style with” and “customer also bought,” as well as links to style guides and relevant editorial, are can be key.’

A big tip is to ‘Think of a PDP as your new homepage and make the experience enjoyable,’ says Scott.

Customers’ willingness to purchase

Customers generally are more willing to make Beauty purchases over other product categories.

Chris Oliveira, at SheerID note how these consumers like the ‘feeling of rewarding oneself with the purchase of something new. This is particularly true for people in high-stress jobs, like teachers and medical professionals, who often put their own needs last.’

‘In a recent survey, we learned that teachers are 29% more likely to have purchased cosmetics in the past month compared to other groups, and medical professionals are 48% more likely to “treat themselves” by purchasing cosmetics,’ says Chris.

‘Appealing to these groups with reward-centric messaging is particularly effective. For example, when Tarte Cosmetics, an eco-conscious cosmetics brand, created a 40% off “Glow Up” gated offer for educators, medical workers and first responders, their TikTok promotion quickly garnered 28K likes, generating social shares and sales among these highly valuable customer groups.’

Composable commerce and delivering newness

Mary Rebecca Harakas, Senior Product Marketing Manager at commercetools shares, ‘Ulta Beauty and Sephora provide two beautiful examples of brands that consistently exceed customer expectations. Fashion retailers could benefit from exploring the strategies that contribute to their success — which include frictionless omnichannel experiences, robust customer loyalty programs, interactive digital makeup and skincare tools, strong social media/influencer marketing and exclusive brand partnerships.’

‘Fashion and beauty customers are always seeking what’s new — trends, products, experiences. The retailers that can deliver newness at speed are the ones winning in these sectors. This is why many have adopted modern, composable commerce . It gives retailers the flexibility and scalability to continually and quickly launch new experiences that keep customers coming back,’ reveals Mary.

Fashion sector struggles

As explored, fashion is struggling significantly more than other online product categories. Experts have revealed why that might be the case and how these retailers can combat declines with effective growth strategies.

Preloved Fashion and connected commerce

Georgia Leybourne, CMO of Linnworks shares ‘There is a mega trend that beauty will escape whilst fashion and apparel will be held to ransom. It’s not going away. It’s called preloved a.k.a secondhand.’

She argues that ‘In today’s fickle consumer world, beauty is top because it is everywhere and it is unlikely that people are going to buy second hand make-up. But clothing is a whole other story. Why? Preloved offerings make unattainable designs 100% achievable. It’s a combination of cost and availability.’

Georgia continues, ‘Marketplace shopping, we know, is top of the agenda for consumers. After all, 51% of consumers surveyed in Linnworks’ 2024 research claimed to prefer shopping on a marketplace to other channels. So, retail should go where the customers are and they can get there using a Connected Commerce Ops.’

Rising costs and retention difficulties

Bring Digital’s Paid Media Director, Sam Morris exclaims, ‘We’ve seen large retailers like ASOS, who previously offered free returns, start charging up to £3.95 unless a minimum spend is met.’

‘Once return fees cross the £3 mark, it can discourage purchases—especially of single items—since customers face the risk of paying extra if they choose to return. While it’s understandable that free returns aren’t always profitable, the combination of higher product prices and added delivery/returns costs is creating a barrier to purchase. This shifts away from the “try-before-you-buy” mindset that many consumers had grown accustomed to.’

In contrast, ‘Beauty customers tend to be more brand loyal. They often stick with preferred products and are influenced by strong retention strategies like subscription models, loyalty schemes, and points-based rewards. These tactics encourage repeat purchases and can prompt customers to add extra items when restocking their usual products. Annual free delivery subscriptions can also grow retention for Clothing retailers.’

What Can Fashion and Beauty retailers learn from each other?

Cross-sector learnings in loyalty, personalisation, and logistics

Lee Thompson, CEO at fulfilmentcrowd describes how ‘Fashion and Beauty retail operate on different cycles, but there’s a lot they can learn from each other. Beauty brands excel at community-driven loyalty, subscription models, and repeat purchasing, while fashion retailers are constantly innovating with AI-driven personalisation and flexible fulfilment.’

Managing both can be done through smart inventory control, ‘ensuring stock is in the right place at the right time.’ Lee says, ‘Our research highlights that 62% of UK shoppers engage in bracketing, making efficient returns management critical. Retailers who streamline logistics, embrace AI-driven recommendations, and enhance sustainability efforts will be best placed for growth in 2025.’

Poppy Scott, Tech Partner Consultant at Awin also highlights that ‘Fashion and beauty retailers can learn from each other by leveraging their strengths.’ She expresses that ‘Beauty’s resilience and growth should inspire fashion to innovate and adapt. Tailoring product recommendations and bundling based on customer behaviour can drive engagement and sales, ensuring both sectors thrive.’

Head of Corporate Relations at Tradebyte, Alexander Otto, explores how ‘Fashion can learn from beauty’s effective use of platforms like TikTok Shop, while Beauty could benefit from fashion’s focus on sustainability and augmented reality experiences.’ Alexander similarly urges retailers to ‘leverage data-driven strategies for seamless cross-selling and efficient inventory management’ when embracing platforms and new experiences.

Managing both Fashion and Beauty effectively

For those retailers who sell both Fashion and Beauty items, they can take various approaches to ensure that both product categories succeed.

Different approaches to merchandising

Andre Brown, Founder and CEO at Advanced Commerce says, ‘Traditionally, the retailers who best managed to combine selling fashion and beauty, are department stores. They achieve this by having very different merchandising strategies.’

‘Both industries leverage digital innovation, influencer marketing, and experiential retail to drive sales. For online retailers that do sell both, Andre recommends ‘combining merchandising with AI based on customer segments—particularly using curated merchandising edits for new users and AI-driven recommendations for returning visitors.’

Show Beauty and Fashion products simultaneously

Industry experts at Prisync celebrates the possibilities within beauty and fashion retail, through embracing a ‘mutual exchange of trends’ and having strong pricing strategies to ‘gain momentum in competitive markets.’

For those retailers selling both product categories, they can ‘consider cross-selling strategies and product bundling – utilising trends like funding augmented reality experiences, content creators, and influencers for social media.’

Prisync say, ‘Influencers can also create custom seasonal wardrobe lists on eCommerce platforms, which consumers can buy as bundles. Brands can release augmented reality video templates on social media or their websites so customers can try their products virtually. So, a user can generate an outfit video by matching a jumper with a lip gloss.’

Omnichannel strategies and mitigating fraud

‘Retailers selling both fashion and beauty can benefit from strong omnichannel strategies and better use of social commerce,’ says Nikhita Hyett, General Manager EMEA at Signifyd.

‘Platforms like TikTok have played a major role in beauty’s success, and fashion brands that integrate this more effectively can capture new audiences. However, increased digital engagement also brings greater risk of fraud, policy abuse, and refund manipulation.

Nikhita shares that ‘Having visibility into transactional data and customer behaviour allows retailers to manage these risks without adding unnecessary friction for genuine shoppers.’

The customer delivery experience (CdX) and post-purchase engagement

Gavin Murphy, CMO at Scurri, comments, ‘To differentiate in a very crowded and competitive market, beauty and fashion brands can take ownership of customer delivery experience (CdX).’

BrandAlley

‘By optimising end-to-end CdX, BrandAlley now monitors performance of every process and carrier, region by region, channel by channel, enabling it to make continuous improvements,’ says Gavin. They use ‘branded tracking emails and customer notifications during delivery to provide greater order visibility for customers.’

Beauty Pie

Having moved away from using a third-party logistics provider, and bringing this function in-house, Beauty Pie is an example of a beauty brand that now has complete control and oversight of the customer journey. It can now easily set shipping rules to manage its logistics network more efficiently, leading to improvements in both order processing and delivery speed.

The Perfume Shop

Gavin shares that ‘The Perfume Shop has extended its relationships with online customers post-checkout using a branded tracking timeline, branded tracking emails, and estimated delivery date notifications.’ Gavin argues that ‘Not only does this improve customer experience, it extends the visibility of The Perfume Shop brand during a time of peak engagement to drive additional sales and engagement opportunities.’

Key takeaways

The varied performances of the fashion and beauty sectors demonstrate the potential for valuable cross-industry learnings. Fashion retailers could benefit from adopting beauty’s strengths in social commerce, loyalty programmes, and authentic customer engagement. Meanwhile, beauty brands might find inspiration in fashion’s approaches to personalisation and sustainability.

By focussing on effective merchandising strategies, robust omnichannel experiences, and a seamless customer delivery journey, retailers managing both categories can navigate the challenges of 2025 with confidence.

Want to read more? Here are some other blogs that might take your interest:

Future of eCommerce: AI & dynamic pricing – IMRG

The adaptive edge: How AI is transforming retail functions and strategy – IMRG

10 top strategies to retain customers in 2025 – IMRG

Bracketing: The customer trend that’s costing retailers millions – and how to manage it – IMRG

What Does AI Mean for eCom SEO? – IMRG

Published 10/03/2025