Online Retailers are Showing Heavy Reliance on Black Friday Week

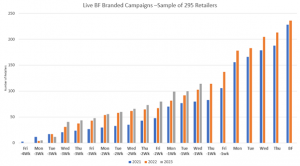

- Retailers pulled forward their Black Friday-branded campaigns this year, with 48 out of 295 retailers tracked by IMRG going live three weeks out from the big week

- 1st of November saw flat revenue growth, at +0.5% Year-on-Year (YoY), and Wk. 2 plummeted to -6.2% YoY, leaving a heavy reliance on Black Friday week for the month to be positive

- In Wk. 1, the product category gifts experienced its first positive result in 20 weeks (+0.6% YoY) but, in Wk. 2, gifts online revenue performance was down -18.1% YoY

21st November 2023: Each year IMRG track online retailers’ Black Friday campaigns, looking at campaign start dates, daily revenue performance, and other unique performance indicators. This year, IMRG have already noted a trend for early campaigning, with as many as 48 out of the 295 retailers surveyed going live three weeks out from Black Friday week itself. This number had steadily grown to 114+ live Black Friday campaigns just one week out, revealing participation and competition is high.

Yet, if early campaigning was an attempt to boost performance, this hasn’t proved successful for many retailers. The results from IMRG’s Online Retail Index, which tracks the online sales performance of over 200 retailers across the UK, supported by anecdotal evidence from the IMRG retail community has shown that the industry is in YoY decline. Nearly 50% of 80 retailers polled on 16/11/23 said their results that week so far were ‘below expectation.’ Total online market performance in Wk. 1 of November was flat, at +0.5% YoY, and just one week later the industry experienced an average of -6.2% YoY. Therefore, we know that many retailers are under significant pressure to meet their targets this Black Friday week.

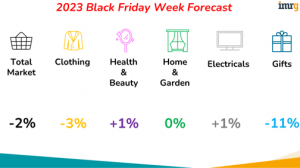

These insights are in line with IMRG’s Black Friday Week (Mon 20th – Mon 27th November) forecast, with expectations for declines across the total online market, as well as for key product categories such as clothing and gifts:

The Black Friday week forecast was based on thorough research into online revenue performance in recent times, as well as external factors such as the cost-of-living crisis which has altered customers’ shopping behaviours. Retailers are hopeful that customers have been awaiting the ‘big deals’ during Black Friday week itself after experiencing two weeks of poor performance, but we are yet to find out the true extent of the problem this week.

Andy Mulcahy, Strategy and Insight Director at IMRG says: “The signs so far in November have not been very positive, and it means there is a lot of ground to be made up if it is to be a successful trading month for retailers. That’s not to say it couldn’t happen; it may be that shoppers are going to concentrate their spend more fully on this week in 2023, and there will likely be some big deals available if demand is slow and they find themselves a bit overstocked. Many will be hoping that the upturn in demand arrives very soon.”

About IMRG’s Black Friday Tracker:

We have tracked online retail performance across Black Friday week for many years and collate the data to inform our community of retailers and industry experts on the latest trends, enabling them to adapt their strategies in real-time.

Daily results are uploaded to the tracker which features on IMRG’s Digital Dashboard. While our normal tracking period is from a Sun-Mon, Black Friday week is from Mon-Mon, to include Cyber Monday.

About the ‘IMRG Online Retail Index’:

The IMRG Online Retail Index, which was started in April 2000, tracks ‘online sales’, which we define as ‘transactions completed fully, including payment, via interactive channels’ from any location.

About IMRG:

For over 20 years, IMRG (Interactive Media in Retail Group) has been the voice of online retail in the UK. We are a membership community comprising businesses of all sizes – multichannel and pureplay, SME and multinational, and solution providers to industry. We support our members through a range of activities – including market tracking and insight, benchmarking, and best practice sharing. Our indices provide in-depth intelligence on online sales, mobile sales, delivery trends and over 80 additional KPIs. Our goal is to ensure our members have the information and resources they need to succeed in rapidly-evolving markets – both domestically and internationally.

Published 21/11/2023